The trade war between the United States and China has grown intense in 2025, with both countries adding taxes, or tariffs, on each other’s goods. These tariffs are causing trouble for businesses, shoppers, and investors, especially in the crypto market.

President Donald Trump started this round of tariffs, and China has responded with its own. This back and forth is affecting markets and creating uncertainty. Let’s go through what happened from February to April 2025, one step at a time.

New Tariffs Begin (February 1, 2025)

President Donald Trump began the year by placing a 10% tariff on all goods coming from China. He said this was to protect America, claiming China’s trade rules hurt U.S. workers.

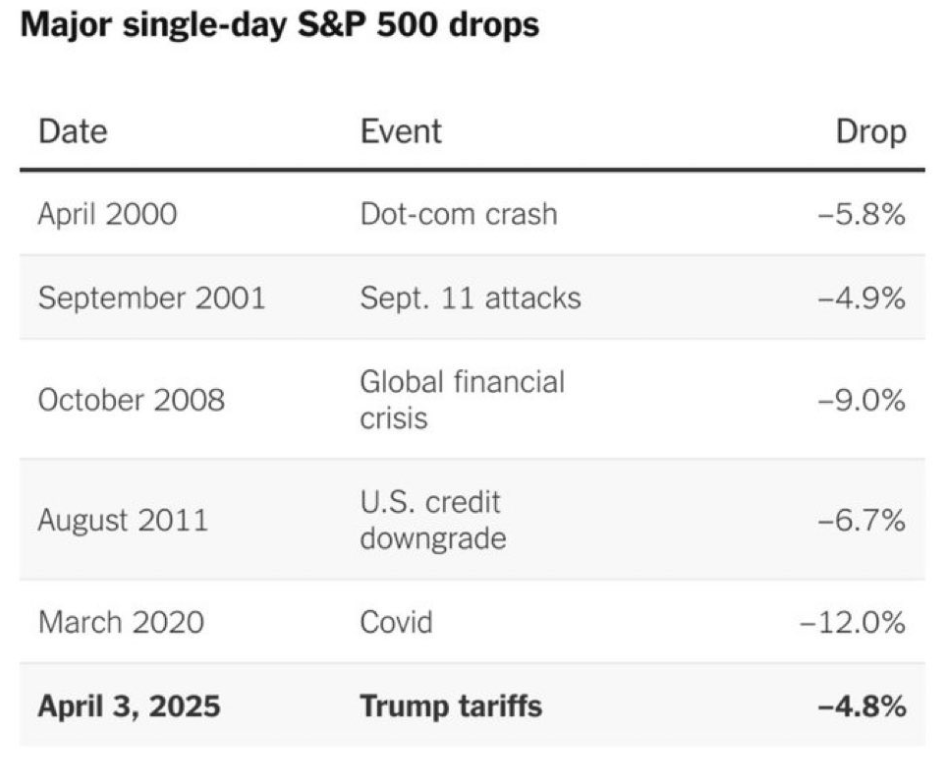

In 2024, the U.S. bought $439 billion worth of Chinese products like phones, clothes, and machines. These tariffs made those goods cost more for U.S. companies, which could raise prices for shoppers. For example, a $20 toy might cost $22 if stores pass on the extra cost. Stock markets dropped slightly, with the S&P 500 falling 0.6%.

In the crypto market, Bitcoin stayed near $80,000, but investors became concerned. Trade wars often make people choose safer options like savings bonds over cryptocurrencies. Crypto traders worried a long conflict could slow the world economy, reducing interest in Bitcoin or Ethereum. Trump used a law called the International Emergency Economic Powers Act to start these tariffs, saying trade issues were a safety concern.

China Responds Quickly (February 4, 2025)

China quickly added tariffs of 10% to 15% on U.S. goods like coal, natural gas, and farm equipment, starting February 10. This hit American farmers and energy companies, who sell a lot to China.

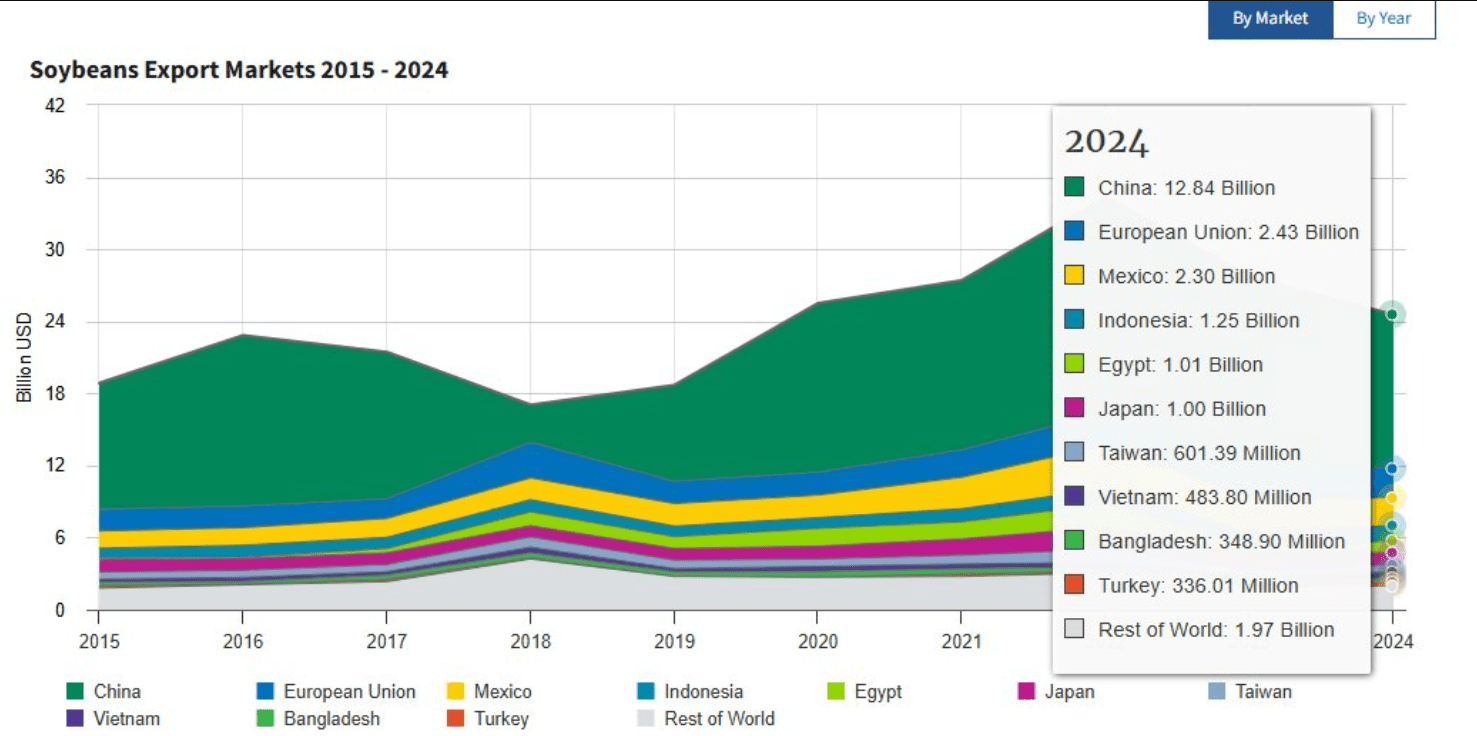

In 2024, China spent $13 billion on U.S. farm products like corn and wheat. Now, those cost more for Chinese buyers, who might shop in places like Australia instead. China’s trade office said the U.S. tariffs weren’t fair and promised to keep fighting.

Stock markets felt the impact, with the Dow Jones down 0.9% and Hong Kong’s Hang Seng falling 1%. Bitcoin dropped to $78,500, and smaller cryptocurrencies like Cardano lost 3%. Investors feared a bigger trade war could slow down the economy, making cryptocurrencies less appealing. China used its Tariff Law, passed in 2024, to put these tariffs in place fast.

Uncertainty Continues to Build (March 4, 2025)

The U.S. increased tariffs on Chinese goods to 20%, twice the original rate. Trump said this was to save American jobs, noting China sold $295 billion more to the U.S. than the U.S. sold to China in 2024. These tariffs made things like clothes and electronics cost more for U.S. stores. A shop buying $1 million in Chinese shirts now paid $200,000 extra in taxes.

China responded with 15% tariffs on U.S. meat, soybeans, and cotton, starting March 12. This hurt farmers, since China buys $14 billion of U.S. soybeans yearly. If China buys from Brazil instead, U.S. farmers lose money.

Stock markets got unstable, with the Nasdaq down 1.3%. Bitcoin fell to $76,500, and XRP dropped 5%, as people chose cash, worried about a major trade war. Crypto people wondered if Bitcoin could be a safe place for money, but it moved like stocks, falling when markets did.

April-2,2025, Trump added a 34% tariff on Chinese goods, making the total 54%. He said this was to make trade fair, because China taxes U.S. products heavily, like 25% on cars, while the U.S. used to charge just 2.5% on Chinese cars.

These tariffs made it tough for U.S. businesses using Chinese parts for things like computers or hospital tools. A company buying $500,000 in parts now owed $270,000 in taxes, cutting profits. Shoppers might see higher prices a $1,000 TV could cost $1,250 by fall.

Stock markets moved up and down, with the S&P 500 down 0.8%.

In crypto, Ethereum fell 7% to $3,100, as people worried pricier tech parts could make crypto mining machines cost more, since they use Chinese chips. The United States Trade Representative office helped carry out these tariffs, following Trump’s plan.

China Limits Important Minerals (April 4, 2025)

China fought back in two ways. First, it limited sales of seven special minerals like samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium which are used in phones, batteries, and military gear. China supplies 80% of these minerals, so this could hurt U.S. companies making electric cars, where one battery might need 12 pounds of dysprosium.

Second, China asked the World Trade Organization to review U.S. tariffs, saying they broke trade rules. China’s trade office called the U.S. unfair and promised to protect its businesses. Stock markets dropped, with the Dow Jones down 1.6% and Shanghai’s CSI 300 falling 2.1%. Bitcoin slid 5% to $72,500, as the mineral limits worried tech companies, which matter for crypto because they make mining equipment.

Some traders thought China’s limits might push people to use cryptocurrencies to move money, but China’s strict rules made that hard. China used its Export Control Law, updated in 2024, to set these mineral limits.

Tariffs See New Highs (April 9, 2025)

Trump hiked tariffs on Chinese products to 125% but suspended tariffs on most nations, such as Japan (24%) and the EU (20%), for 90 days. He explained this would make trade more equitable and bring factory jobs to states such as Pennsylvania.

The 125% tariffs made Chinese products extremely costly, as a $100 Chinese toy now had a $125 tariff, so shops may not purchase them anymore. The delay on other nations’ tariffs lifted stock markets, with the Nasdaq rising 12%, its largest day since 2001.

Bitcoin jumped 4% to $76,000, following stocks, but crypto traders remained wary, holding out for China’s next step. Individuals feared high tariffs would make tech components more expensive, which is important for crypto because blockchain computers require those components.

Market Impact Appears Inconsistent (April 9, 2025)

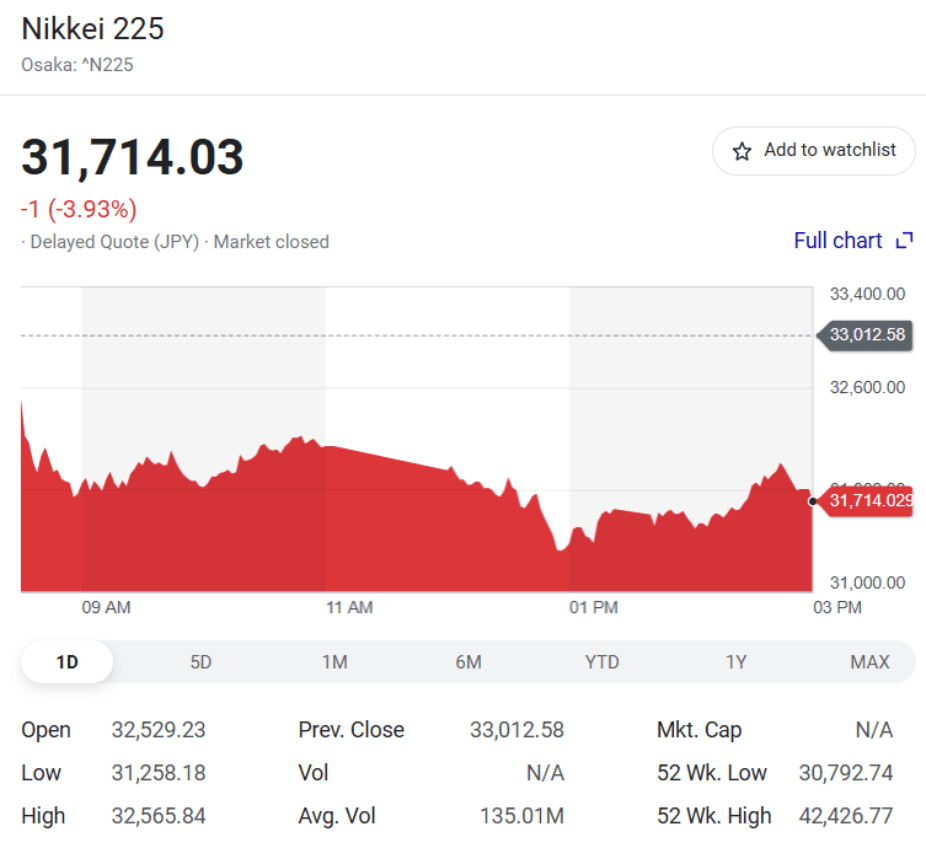

The tariff break for the majority of nations eased some anxiety, but the U.S.-China battle left markets on edge. Wall Street performed well, but China’s CSI 300 declined 1.3%, and Japan’s Nikkei 225 lost 0.9%.

In cryptocurrency, Bitcoin remained at $76,000, but smaller coins such as XRP dropped 9% to $1.75, as individuals chose larger cryptocurrencies over riskier ones. Pricier tech components from tariffs might make crypto mining more difficult, as a $2,000 computer for mining could cost $2,600 if components become more expensive.

Some traders believed China’s monetary issues would enhance cryptocurrencies’ appeal for border to border money transfers, but tough regulations in both countries made this unlikely.

China Raises Its Tariffs (April 10, 2025)

China increased tariffs on U.S. products from 34% to 84%, targeting such items as grains, machinery, and chemicals. An American business selling $1 million of machines to China now had to pay an $840,000 tax and so was almost not able to sell there. China’s trade office requested negotiations but stated it would continue to battle, claiming that America was being unfair.

The stock markets declined with the Dow Jones down 1% and the Nikkei 225 plunging 3.2%. Bitcoin dropped 6% to $74,500, and Ethereum declined 5%, erasing $400 million in crypto wagers. China’s central bank, the People’s Bank of China, reduced purchases of U.S. dollars to support its currency, the yuan, and added more volatility that can impact cryptocurrencies such as Tether.

Businesses Experience Hard Times (April 2025)

Companies were required to respond promptly. One of Apple’s manufacturers confirmed it would move its factories to countries like Vietnam to avoid being impacted by the 125% tariffs, which would increase the price of iPhones by 10% and delay them.

Nintendo postponed its new Switch 2 game console in the U.S. due to Japan’s 24% tariff and supply issues. Jaguar Land Rover ceased shipping vehicles to America because of a 25% vehicle tariff, which was painful because America is a large market for them.

These changes affected tech and automaker stocks, and the crypto market often moves in a similar direction. For example, if Tesla’s stock drops by 10%, Bitcoin might fall by around 3%. Supporters of cryptocurrency are concerned that higher technology costs could slow the growth of blockchain businesses.

Colorado Hurts from Tariffs (April 2025)

In Colorado, businesses buying $1.8 billion worth of Chinese goods like furniture and electronics paid huge costs due to the 125% tariffs. A Denver store buying $500,000 worth of merchandise now had to pay $625,000 in tax, possibly resulting in firing employees or raising prices by 25%.

Crypto investors in Colorado, who happen to be small business owners, sold off Bitcoin to settle bills, further compressing crypto prices. Technology startups that use Chinese components also suffered, which may discourage new blockchain ideas.

Market Prices Continue to Shift (April 2025)

Crypto markets have been volatile a lot. Bitcoin dropped to $74,500, acting more like stocks than a money haven like some had anticipated. Ethereum and XRP dropped 5%.

Tariffs that increase the cost of tech parts could affect crypto mining. For example, a computer that costs 3000 dollars would now cost 3750 dollars. Some traders believed China’s money rules might push more people toward crypto, but strict laws in both countries made that difficult.

Analyzing the Next Phase of Trade and Markets

With U.S. tariffs at 125% and China’s at 84%, this trade war isn’t letting up. China’s World Trade Organization case and mineral restrictions indicate a long battle.

These changes highlight the strong connection between global trade and the crypto market. As companies revise their strategies, each tariff decision has a major impact on trade, technology, and the future of digital assets.

Also Read: Trump Initiates America-China Trade War with Tariff Increase