- USDC Outflows, Hyperliquid has witnessed more than $340 million of USDC outflows after the scandal surrounding JELLY, reflecting a similar $300 million outflow attributed to a Bitcoin whale liquidation.

- JELLY Token Volatility, The JELLY token spiked by 429% before being delisted, spooking investors and prompting enormous market responses, resulting in speedy liquidations.

- USDC Reserves Decline, Hyperliquid’s USDC reserves have declined from $2.58 billion to $2.02 billion over the last 30 days, which can be indicative of investor worries regarding platform stability and risk management.

A $340M Downfall Unfolds Hyperliquid Token

The drama began when Hyperliquid’s treasury shorted JELLY by $5 million, a token that suddenly spiked by 429% in value. The price surge, widely believed to be the result of market manipulation, drove the treasury’s unrealized losses to $10.63 million. Accounts indicate that had JELLY hit $0.17, the possible loss could have escalated to an astonishing $240 million.

Blockchain analytics company Parsec followed the swift outflows over $340 million in USDC back to the hours after the JELLY liquidation event, echoing an earlier $300 million outflow associated with a liquidation by a Bitcoin whale.

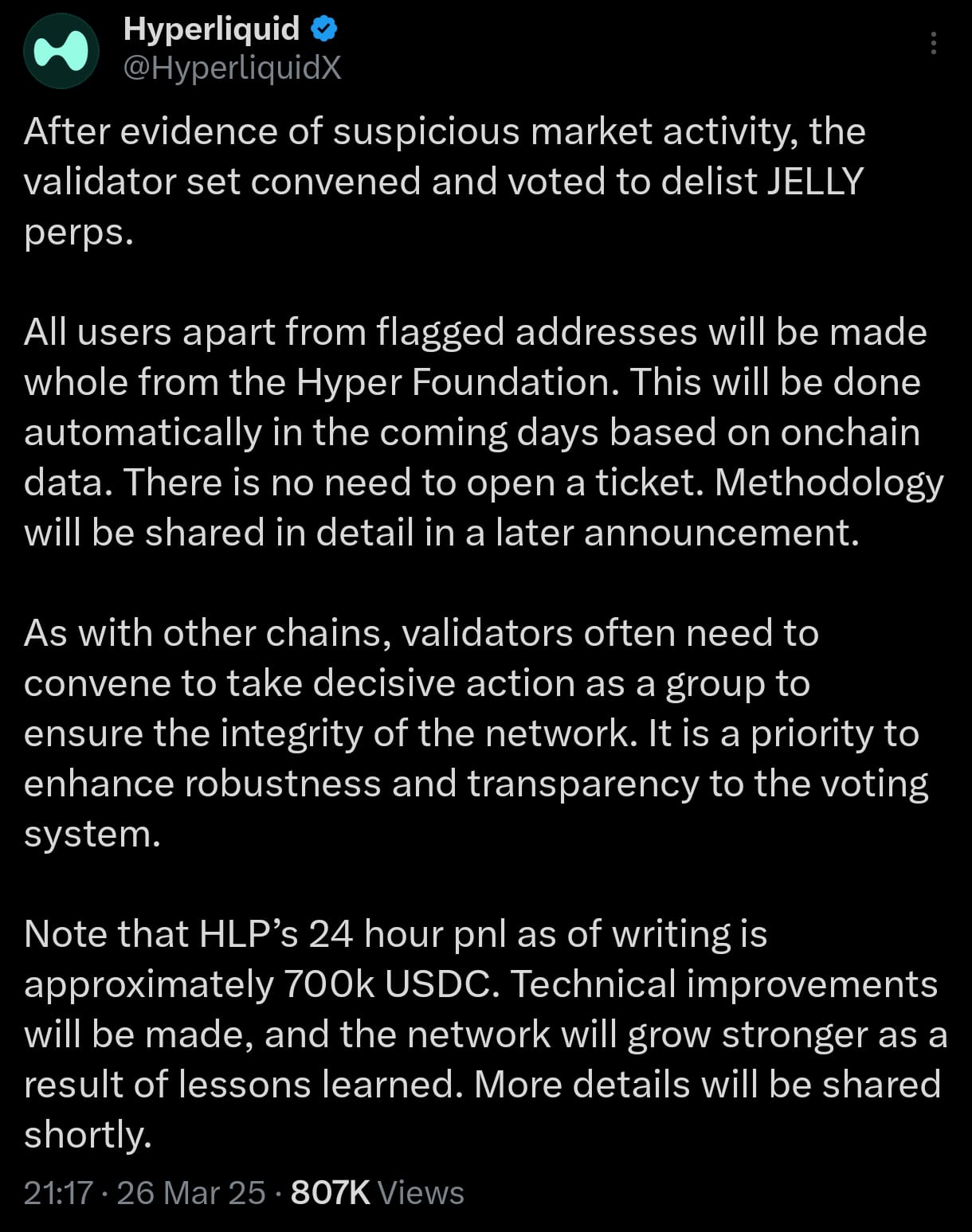

The drama intensified when an address known as “0xde95” opened a gargantuan 430 million JELLY short position on HyperliquidX, only to withdraw its margin soon after, fueling suspicions of coordinated manipulation. In retaliation, Hyperliquid’s validator committee voted to delist JELLY perpetual contracts and forcibly settled all positions at $0.0095 a measure aimed at stemming further harm but one that ignited outrage among users and observers.

Market Reaction on Downfall

Based on information from blockchain analytics company Parsec, the recent outflows happened within hours of the JELLY liquidation event, which is part of a larger trend of investor discomfort. This is similar to an earlier event when a Bitcoin whale liquidation resulted in about $300 million in outflows from the platform. The frequent instances of massive capital flight indicate increasing concerns regarding Hyperliquid’s risk management and asset security.

Predictions on the HYPE Token

Hyperliquid is now under increasing pressure to regain investor’s confidence. In an effort to contain the damage, the exchange will have to step up efforts in transparency, communication with users and its risk management system. Whether the platform survives this and regains its credibility. But, at the moment, traders and investors are walking on eggshells during the turmoil.

As the cryptocurrency market continues to develop, episodes such as the JELLY controversy remind one of the risk and volatility that come with trading digital assets. Investors are reminded to perform detailed due diligence before taking part in high risk trading on any site.

Also Read : How Hyperliquid Turned a Crisis Into Profit?$12M Disaster or Genius Move?