- The US SEC has a sandbox for tokenized securities, allowing firms to experiment with blockchain technology without risking legal penalties.

- It wants to make long term crypto regulations easier to help foster innovation and simplify business hurdles.

- IT provided guidance for transparent disclosures on crypto assets to safeguard investors while evolving to the industry.

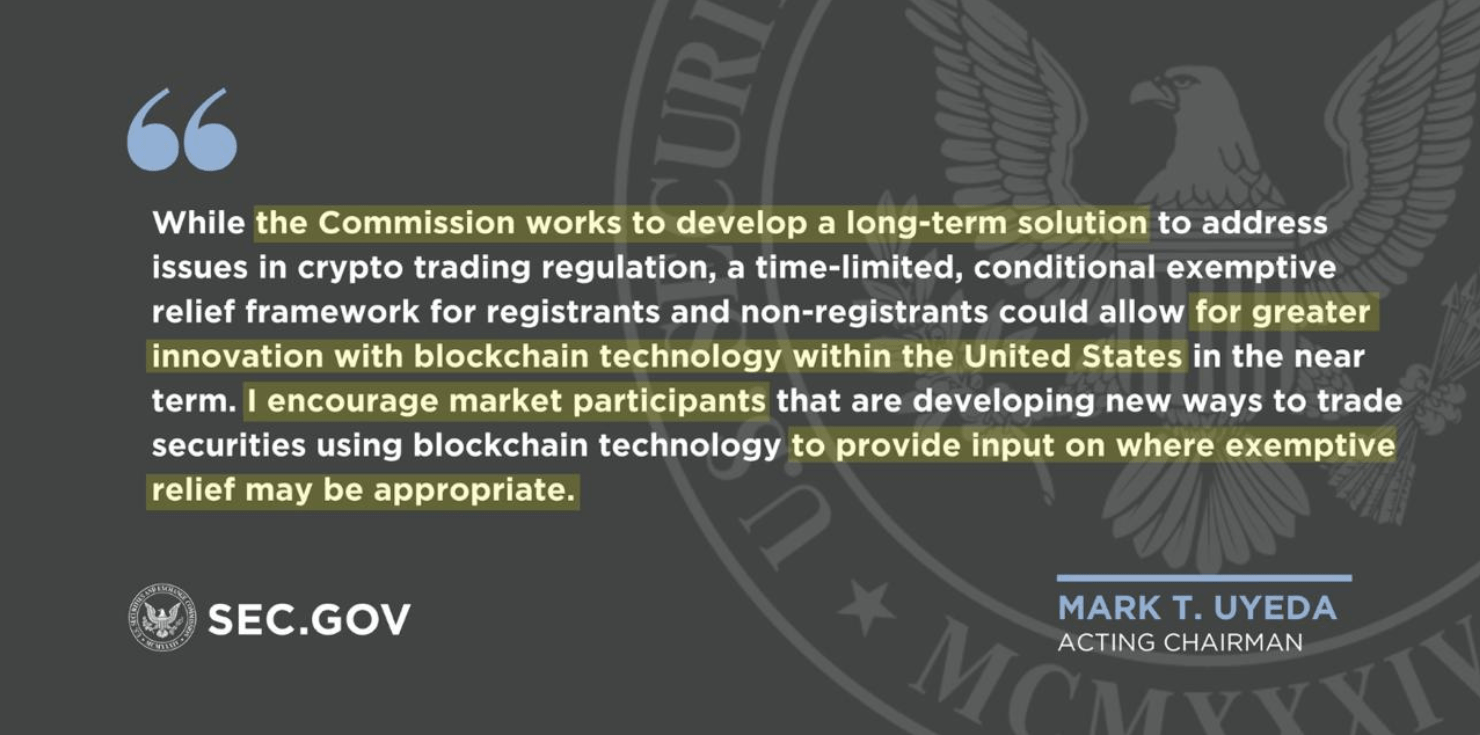

The US SEC is refining the way it addresses crypto regulations. During a recent Crypto Task Force roundtable, Acting Security Exchange Commission Chair Mark Udeya revealed plans for a new strategy.

The Security Exchange Commission hopes to establish a sandbox for tokenized securities, allowing companies to experiment with new technology without legal consequences. The sandbox would be comprised of registered and unregistered companies, illustrating its interest in supporting blockchain expansion while maintaining regulation.

US SEC’s Sandbox Strategy

Terrett defined a sandbox as a setup where companies are allowed to operate outside current laws for a limited time. This gives the regulator a chance to create specific rules for new technologies like crypto.

In contrast to the past, when regulators often took legal action against companies for not following rules, this strategy encourages innovation. Udeya stated, that we want to provide temporary relief for companies handling tokenized securities, allowing them to operate more easily in the U.S.

This step comes after the decision to pause legal action against Binance, showing a shift toward a more cooperative approach by the regulator.

Udeya highlighted that the goal is for the U.S. to lead not just in technology, but also in innovation. Long-term efforts are underway to simplify rules for companies offering crypto assets, whether or not these assets are classified as securities. This step could help reduce the difficulties companies in the crypto market are facing.”

Establishing Sustainable Crypto Governance Structures

Earlier, new regulations were issued on how companies should disclose details about crypto assets considered securities. The Division of Corporation Finance asked businesses to provide clear and honest information in their business descriptions, risk factors, and financial reports.

This move aims to protect investors while keeping up with the fast-changing crypto market. The updated rules and the introduction of a regulatory sandbox reflect a step toward balancing firm supervision with support for innovation.

Also Read: Paul Atkins As US SEC Chair, Senate Confirms, New Way Rises