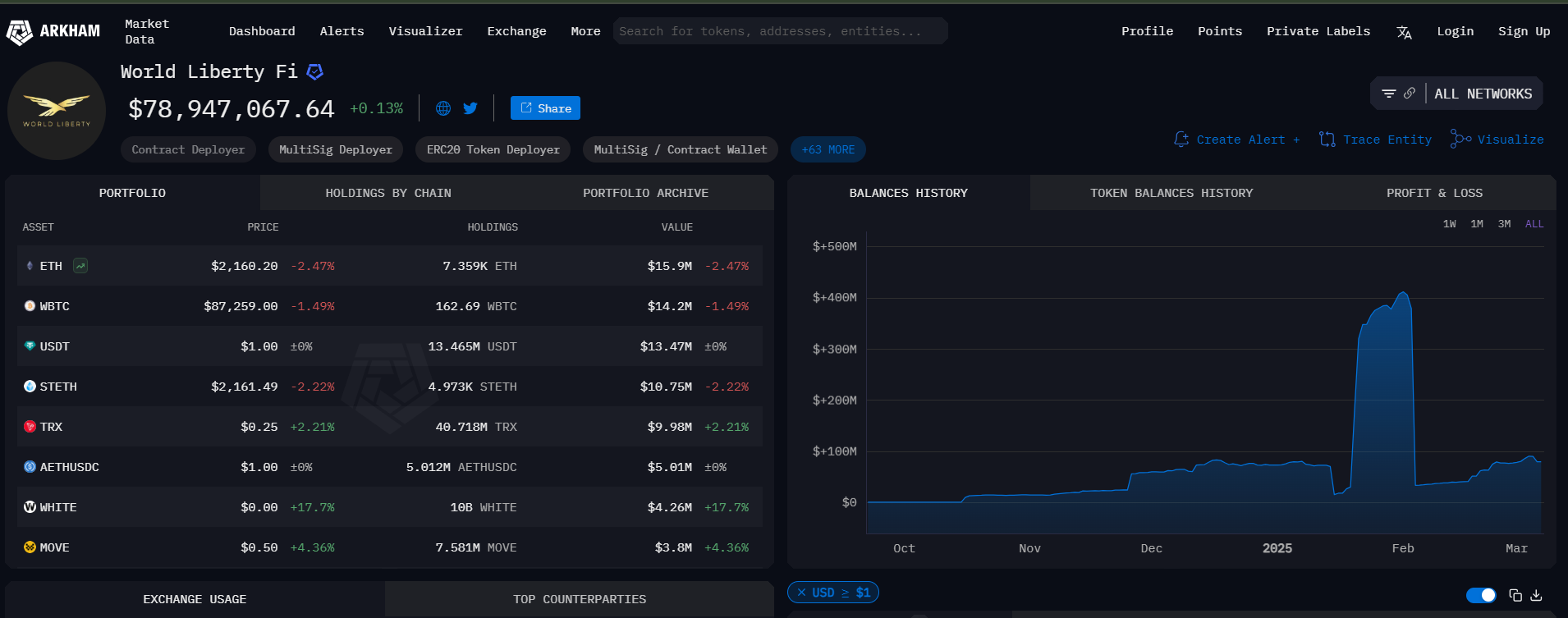

- WLFI linked to Donald Trump, purchased over $20 million in crypto, including Ethereum and Wrapped Bitcoin, just before a major White House crypto summit.

- The crypto market has been recovering, driven by increased liquidity and investor confidence, with analysts predicting a possible Bitcoin rally.

- The project faces controversy, with reports of token swaps raising concerns, while discussions continue on a potential US strategic crypto reserve.

WLFI has just spent more than $20 million on cryptocurrencies such as Ethereum.

WLFI Buying Millions Before Crypto Summit

Blockchain records show that the project’s wallet purchased $10.1 million worth of ETH, $9.9 million worth of Wrapped Bitcoin (WBTC), and $1.68 million worth of MOVE, a token on the Movement Network.

The purchase of WLFI occurred only two days prior to a high-profile crypto summit at the White House. Although most people are speculating about the motivation behind the action, the representatives of the project have not made any comments on the issue.

Steve Witkoff, a current envoy of the President to the Middle East, and his son Zach Witkoff are other notable figures associated. One of the project’s co-founders, Chase Herro, has signaled that they may establish a strategic crypto reserve down the line.

Crypto Market Recovers

The crypto market, which fell earlier in the week, has been recovering, in part due to the excitement over the White House summit. Large investors are also taking advantage of lower prices to buy more, which has helped the market regain confidence.

Also, some analysts are referring to an increase in the Global M2 Money Supply, raising liquidity and usually favoring risk assets such as cryptocurrencies.

Crypto analyst Colin Talks Crypto commented that a surge in money supply might unleash a significant rally for Bitcoin and other cryptocurrencies and estimated that March 25 might be an important day for BTC.

Market Movements

Another expert, Rekt Capital, opines that current market conditions have enabled big players to buy Bitcoin at cheaper prices. He also predicts that Bitcoin may get to a level of approximately $120,000 in the mid-term when institutional demand increases and the Bitcoin halving event draws near.

Despite the hype, World Liberty Financial has been controversial. A report indicated that the project was selling its future WLFI tokens to other projects in exchange for buying their tokens. The company, however, refuted the allegations, saying that they were merely redistributing assets for business use.

World Liberty Financial has been at the forefront of buying cryptocurrencies, with over 66,000 ETH as of January. Their recent crypto purchase is getting attention, especially with talks about a US crypto reserve ongoing. The prospect of a reserve, which may confer special status to Bitcoin, has been trending.

Crypto investor David Sacks recently criticized the US government’s earlier selling of Bitcoin, stating that not selling it might have yielded billions in value. While crypto policy discussions are ongoing, most investors are keenly observing how the US government will handle digital assets going forward.