- Trump’s tariffs led to market volatility, with Bitcoin temporarily falling but rebounding to $80,000.

- Increasing bond yields indicate inflation fears, potentially fueled by tariffs, affecting stocks more than Bitcoin.

- Bitcoin didn’t react as strongly, which shows it may be acting differently from traditional markets like tech stocks.

President Donald Trump’s recent tariff policy led to large scale market dislocation last week, resulting in heavy losses to world stock and bond markets, also affecting cryptocurrency investors.

One of the leading cryptocurrencies, Bitcoin, fell below $75,000 on Monday morning but regained a position around $80,000, rising by 3% in 24 hours. However, despite the current recovery, analysts predict greater volatility as the markets adapt to the new economic situation under the Trump administration.

Bond Market Insights

Analysts are observing American bond markets closely to see what these trends mean.

Recently, bond yields rose and stock prices declined, indicating sophisticated market trends. Rising its yields typically indicate expectations of economic expansion or inflation rising, but can also reflect investors offloading bonds to achieve cash during market downturns.

Other experts believe Trump’s tariffs could lead to inflation as they may raise the cost of goods. There is also concern that other countries would reduce their purchases of U.S. treasuries as a result of these tariffs, again impacting bond yields.

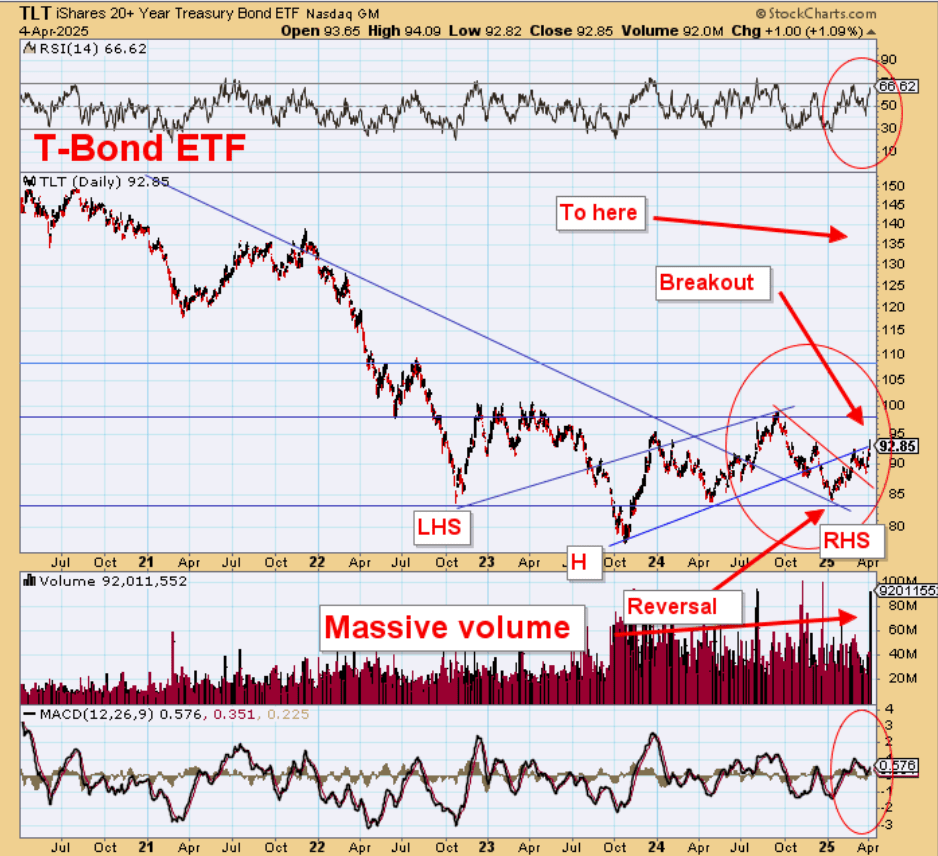

On April 5, analyst Barry Dawes tweeted that U.S. Treasury bond yields are expected to fall, which means its prices like TLT could see a strong increase. A chart pattern points to a possible 30 percent rally. With a 4 percent yield and solid upside, U.S. bonds may attract money and talent from the UK and EU, where high taxes are driving people away. This could lead to a strong U.S. economy and a stronger dollar.

Bitcoin’s Independent Move

To crypto traders, the reaction of Bitcoin to the changes was not that terrible compared to the experience with stocks. While stocks fell a lot, Bitcoin didn’t drop much, and some think it may not follow traditional markets as closely anymore.

It is observed that Bitcoin’s steadiness at this time indicates it might be moving differently than other risk assets, such as tech stocks, which usually do well in low interest rates.

Yet, the larger market environment remains uncertain. The ongoing inflation might compel central banks to maintain elevated interest rates, which could potentially test riskier assets, including cryptocurrencies.

Also Read: The Global Bitcoin Reserves Race: Nations Compete for Digital Wealth 2025