- Tether bought $458.7 million worth of Bitcoin (4,812.2 BTC) for Twenty One Capital on May 9.

- Twenty One Capital’s Bitcoin holdings are now 36,312 BTC, aiming for 42,000 BTC by launch.

- The firm, backed by Tether and SoftBank, plans to compete with Strategy for Bitcoin investment.

Tether, the company that issues the stablecoin, has purchased $458.7 million worth of Bitcoin for Twenty One Capital.

On May 9, Tether bought 4,812.2 Bitcoin at $95,319 each and placed them in an escrow wallet. Cantor Equity Partners reported this in a May 13 filing with the US Securities and Exchange Commission.

Twenty One Capital, a Bitcoin investment firm supported by Tether, is preparing to merge with Cantor Equity Partners. After the merger, Twenty One Capital will trade under the ticker XXI.

Twenty One’s CEO, Jack Mallers, said on May 13 that they’re already in the approval process of the merger, but didn’t give an exact estimate on when the transaction would be complete.

Tether Adds to Twenty One’s Bitcoin Holdings

Tether’s purchase has raised Twenty One Capital’s Bitcoin holdings to 36,312 BTC. Cantor Equity Partners currently holds 31,500 BTC for the firm.

Tether and the crypto exchange Bitfinex are major stakeholders in Twenty One Capital. Cantor Fitzgerald, a Wall Street firm, is guiding the merger and has arranged $585 million in funding for Twenty One’s Bitcoin investments.

SoftBank, a Japanese investment company, has also put $900 million into the firm, which is led by CEO Jack Mallers. On May 13, Mallers said the merger approval process is ongoing but did not say when it will finish.

Competing with Strategy

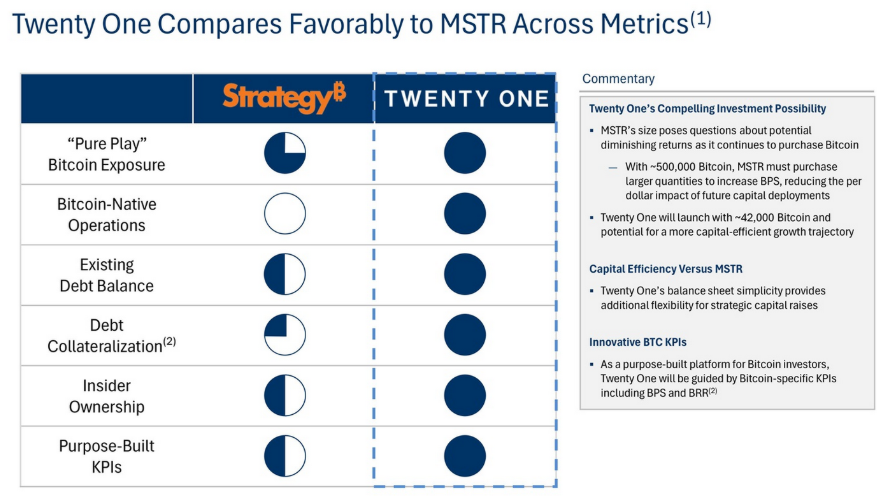

Twenty One Capital wants to challenge Strategy, previously called MicroStrategy, which holds 568,840 Bitcoin.The company seeks to be the most suitable choice for Bitcoin investors.

In an April SEC presentation, Twenty One Capital stated it would look to Bitcoin per share rather than earnings per share, providing a direct Bitcoin investment.

Twenty One Capital’s comparison of its Bitcoin treasury plan to that of Strategy’s.

Source: SEC

The company plans to hold 42,000 Bitcoin by its launch, with 23,950 BTC from Tether, 10,500 BTC from SoftBank, and about 7,000 BTC from Bitfinex, converted into equity at $10 per share.

Twenty One Capital is the third largest corporate Bitcoin holder, after Strategy and MARA Holdings, which has 48,237 BTC. Cantor Equity Partners’ share price rose from $10.65 to $59.73 on May 2 but later fell to $29.84. It gained 5.2% in after hours trading after Tether’s latest Bitcoin purchase.

Also Read: War and Peace: India-Pakistan Truce and Defining an Act of War