- Hackers made off with $1.67 billion via crypto hack in Q1 2025, with the Bybit hack itself costing $1.45 billion, demonstrating just how serious crypto security problems have gotten.

- Governments imposed stricter regulations such as the US Crypto Reserve and EU’s MiCA, but attacks and scams still increased, affecting Ethereum the most with $1.54 billion lost.

- A paltry 0.38% of the stolen money was recovered, and experts such as CertiK’s Gu indicate stronger code testing, monitoring, and training are necessary to combat smarter hackers.

The first months of 2025 were eventful for crypto and crypto hack. Governments intervened with tighter regulations—such as the US establishing a Strategic Cryptocurrency Reserve and a dedicated SEC team for crypto, and the EU implementing stricter MiCA regulations.

They wished to make things secure and transparent for all users of digital money.

But despite all of that crypto hack, hackers had a blast. They raked in more money than ever before, orchestrating scams and attacks that drained billions from wallets and trading platforms.

One enormous blow drained more than a billion dollars in one fell swoop, leaving the crypto community in shock.

The Bybit cryptoF Hack Shakes the Industry

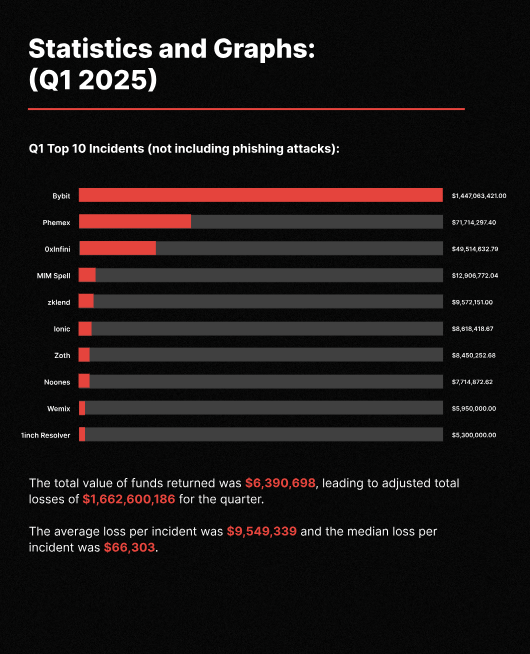

So, what did happen? How did things go so terribly wrong? Let’s get into it. According to CertiK’s Q1 2025 Web3 Security report more than $1.67 billion got stolen in 197 different attacks during Q1 2025—that’s over three times more than the last quarter.

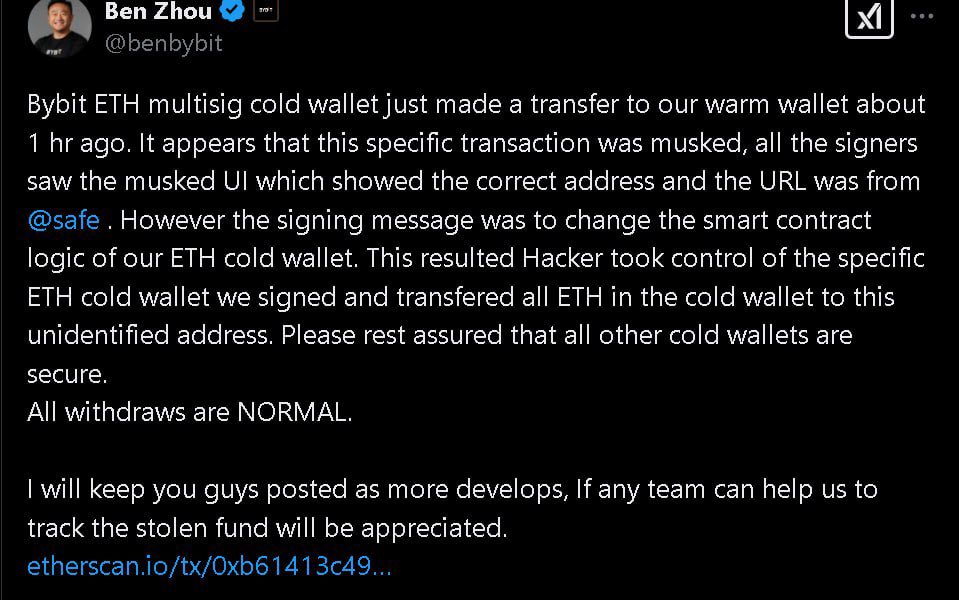

It’s already more than half of what was lost all last year, showing how bad the hacking problem has gotten. The largest blow was the Bybit crypto hack, where $1.45 billion disappeared. It shook the entire industry and caused people to really fear how secure large exchanges are. Experts and regulators are now calling hard for greater protection to prevent this type of catastrophe.

“The increasing sophistication of hacker techniques highlights the pressing need for blockchain entities to enhance their security strategies,” said, CertiK Co-Founder Ronghui Gu.

He said that, hackers are becoming more intelligent, employing sneaky new methods to gain entry. He referred to the Bybit debacle as a loud alarm, stating security is no longer an added bonus but something everyone in crypto must work on collectively.

Other sites were hit as well: Phemex lost $71.7 million, 0xInfini lost $49.5 million, and MIM Spell lost $12.9 million. Much of the loss resulted from stolen wallet keys, with $142.4 million lost in 15 incidents. Vulnerabilities in code caused $47.1 million lost in 68 attacks, and phishing messages fooled people out of $15.8 million in 81 attacks.

Recovery Efforts Fall Flat

Recouping the money? Practically impossible. It recovered only 0.38% of it—far fewer than the 42% it recovered last quarter. February was a complete loss, with zero returned. Crypto hacks are like trust tricks, artificial intelligence, and code manipulations to sneak by even robust defenses.

Ethereum was the hardest hit, losing $1.54 billion in 98 attacks. It’s an easy target because so much value is locked in its DeFi and smart contract platforms, which still have vulnerabilities.

Ranghui Gu says the cure is layering up safety, checking code carefully, watching for unusual moves, having a quick plan in case things go wrong, testing defenses often, and training employees to recognize trouble. With crypto expanding and crypto hack are worsening, security and regulation are necessary to prevent things from crashing.

Also Read: Did Trump Tariffs Crash the Crypto Market? Investors Lose $500M?