- Gemini files for an IPO after the SEC drops its investigation, clearing a major hurdle.

- The U.S. will keep seized crypto but won’t buy more, sparking mixed reactions.

- Cases against Coinbase, Gemini, and Uniswap dismissed, hinting at relaxed regulations.

The SEC has now dismissed cases against Coinbase, Gemini, and Uniswap, which is a clear sign that the tide is turning towards lenient crypto regulations, although uncertainty in the market persists.

Gemini filed for IPO

Gemini, the cryptocurrency exchange established by Cameron and Tyler Winklevoss, As per report they has confidentially filed for an IPO with Goldman Sachs and Citigroup’s help Gemini filed privately for an IPO with Goldman Sachs and Citigroup after the SEC ended its two-year investigation, clearing a major hurdle for the exchange.

Trump announced the U.S. will hold onto Bitcoin and other cryptocurrencies recovered in legal cases but won’t use taxpayer money to buy more, leading to mixed reactions.

The firm hasn’t made up its mind yet, but the IPO might materialize this year. This follows shortly after the White House crypto meeting and barely weeks after the SEC formally concluded its lengthy investigation into Gemini.

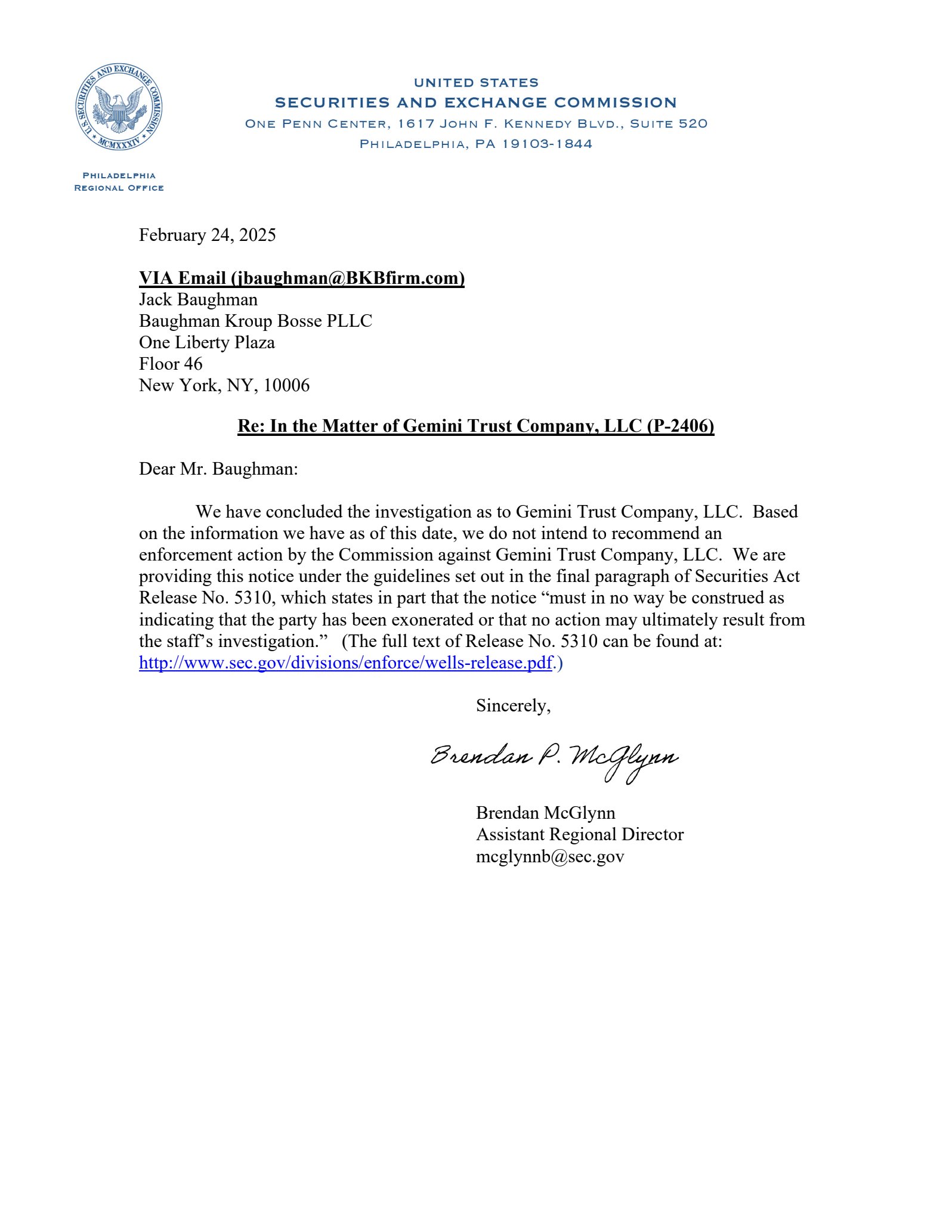

The investigation took almost two years and cost the firm millions of dollars in attorneys’ fees. Cameron Winklevoss solidified the SEC’s move by posting a letter from the regulator, which noted no enforcement action would be initiated. He railed against the SEC for causing unnecessary hassle and then abruptly terminating the case with no explanation.

The closure of the investigation wipes out a giant hurdle for Gemini and paves the way for its public listing.

Trump’s Bitcoin Reserve Plan Raises Questions

Donald Trump’s crypto conference at the White House was high-profile, featuring 30 prominent crypto officials and executives, among them Cameron and Tyler Winklevoss. Trump revealed the U.S. government would have a national reserve of Bitcoins and keep the cryptocurrencies recovered in law cases.

Trump promised no money from taxpayers would be utilized in purchasing Bitcoin but reactions were uncertain. Others viewed it as a sign that the government was acknowledging Bitcoin, while others thought it was symbolic and had no actual impact.

Analysts also noted that Trump’s move could be undone by subsequent administrations since it was not supported by law. Others also pointed out that the government was not purchasing Bitcoin but merely keeping seized assets.

Changing SEC Policies and Market Reactions

The recent SEC actions demonstrate the change in attitude of the commission towards regulation in the crypto sphere. In addition to abandoning the Gemini case, the agency ceased investigations of Coinbase and Uniswap as well.

This may indicate a relaxed approach by the Trump administration to advocate for lesser restrictions in the crypto space. Meanwhile, the Winklevoss twins have been strong supporters of Trump’s crypto policies and even made large Bitcoin donations to his campaign.

With their IPO plans moving forward, they are betting that a recovering crypto market and Trump’s support will help Gemini grow.

The price of Bitcoin held steady at $88,000 following Trump’s announcement, with some coins increasing marginally while others decreased marginally. However, analysts are still unsure about the overall market situation.

They feel that general economic conditions may continue to slow down crypto growth, even as Trump’s positive attitude may be welcomed. Investors are waiting to see whether the new policies will have any real impact on the sector.