- Sygnum says Solana won’t beat Ethereum soon as big companies prefer it’s security and stability.

- It earns more money than Solana, but Solana’s memecoin heavy income is seen as risky.

- Solana could grow if it focuses on stable areas like tokenization, while it leads in key financial uses.

Institutional Blockchain Preferences

On May 8, 2025, Sygnum, a crypto banking group, explained why Solana is unlikely to overtake Ethereum as the top blockchain for major financial companies soon. In a May 8 blog post, They said it is favored for its security, stability, and long track record.

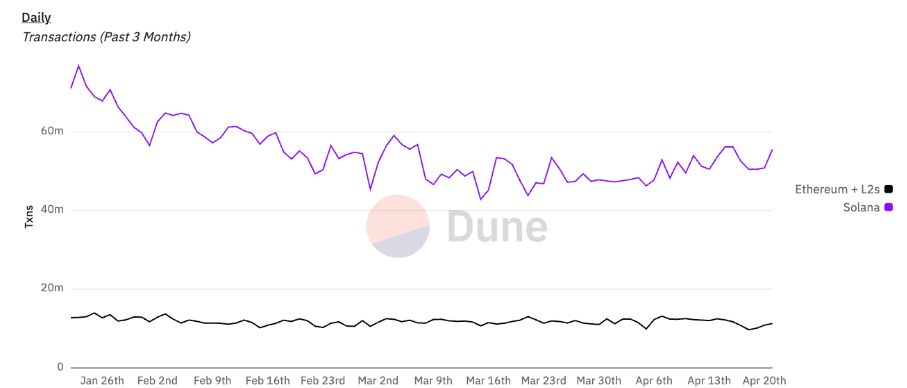

Solana has been in the spotlight for processing lots of transactions and earning more fees recently, but Sygnum pointed out that its money comes mostly from memecoins, which are seen as risky. Big companies prefer platforms with steady income, and that gives ethereum an edge.

Ethereum’s Market Leadership

Ethereum leads in areas like tokenization, stablecoins, and decentralized finance, which are popular with governments, regulators, and banks. Sygnum noted that it earns two to two and a half times more money than Solana, even if Solana handles more transactions.

Transactions on Solana (purple) far exceed those on Ethereum and its layer 2s, but the latter has more value locked onchain. Source: Dune Analytics

Solana’s fees mainly go to validators, not to increasing its SOL token’s value. Ethereum’s system, though sometimes questioned for quieter main network activity due to cheaper side networks, is viewed as more reliable.

In March, Solana’s community rejected a plan to lower its token’s inflation rate, which could have helped its value. Meanwhile, it’s team recently focused on improving its main network, lifting people’s confidence and pausing its two year lag behind Solana.

Solana is growing in decentralized finance, with more money tied to its projects. Sygnum said if Solana shifts to stable income sources like tokenization or stablecoins, it could get closer to Ethereum. For the time being, it is the favorite among major players since it’s trusted and utilized for more purposes.

Sygnum finds Solana active and quick, but still lagging behind Ethereum in terms of profits and trust from large institutions.

Much of Solana’s revenue is generated through memecoins, and its token configuration may keep it behind. But if Solana were to move towards more stable grounds, it may emerge as a stronger competitor to Ethereum in the future.

Also Read: Bitcoin Climbs to $103,000 Following Federal Reserve’s Decision to Keep Interest Rates Unchanged