Bitcoin Standing Firm and Quiet

Bitcoin didn’t experience the massive movements that it has done in previous weeks but remained constant, that crypto weekly with a steady and gradual gain, reaching levels of approximately $96,000.

This understated movement can be an indicator that Bitcoin is in the stage of accumulation wherein long-term buyers are accumulating and holding and not selling.

Interesting enough, the supply of Bitcoin on exchanges also fell to 5-year low levels, something that typically implies that fewer individuals are intending to sell their Bitcoins. This type of low supply on exchanges tends to indicate a possible price rise in the near future, particularly when demand remains high.

The rising popularity of Bitcoin ETFs has been a key factor for the robust demand. They enable conventional investors to invest in Bitcoin simply by purchasing it, similar to stocks, without any exposure to wallets or exchanges. To date, more than $112 billion has poured into Bitcoin ETFs.

This institutional investment brings in an additional dimension of credibility and long-term commitment towards Bitcoin. If this continues, we could see Bitcoin making new price records again in the near future.

Vitalik’s New Ethereum Plan

Ethereum co-founder Vitalik Buterin has put forth a new proposal to make Ethereum easier to use and more secure. He wishes to enhance users’ ways of handling their Ethereum accounts by implementing social recovery, session keys, and simpler wallet logins.

These modifications may make it easier for people to engage with Ethereum-based applications (termed dApps) smoothly, without having to think as much about key loss or navigating complicated security procedures. Simply put, Ethereum is eager to become more like a well-oiled app and less like complex software.

As Ethereum’s price remained at approximately $1,839 this week, the long-term advantages of this strategy can be enormous. One of the most significant steps if we are to get more people to utilize it in everyday life is making Ethereum more user-friendly.

This also benefits developers constructing on Ethereum, particularly Layer 2 projects such as StarkNet and zkSync. With these developments, Ethereum could end up being the preferred platform for new users and big institutions alike.

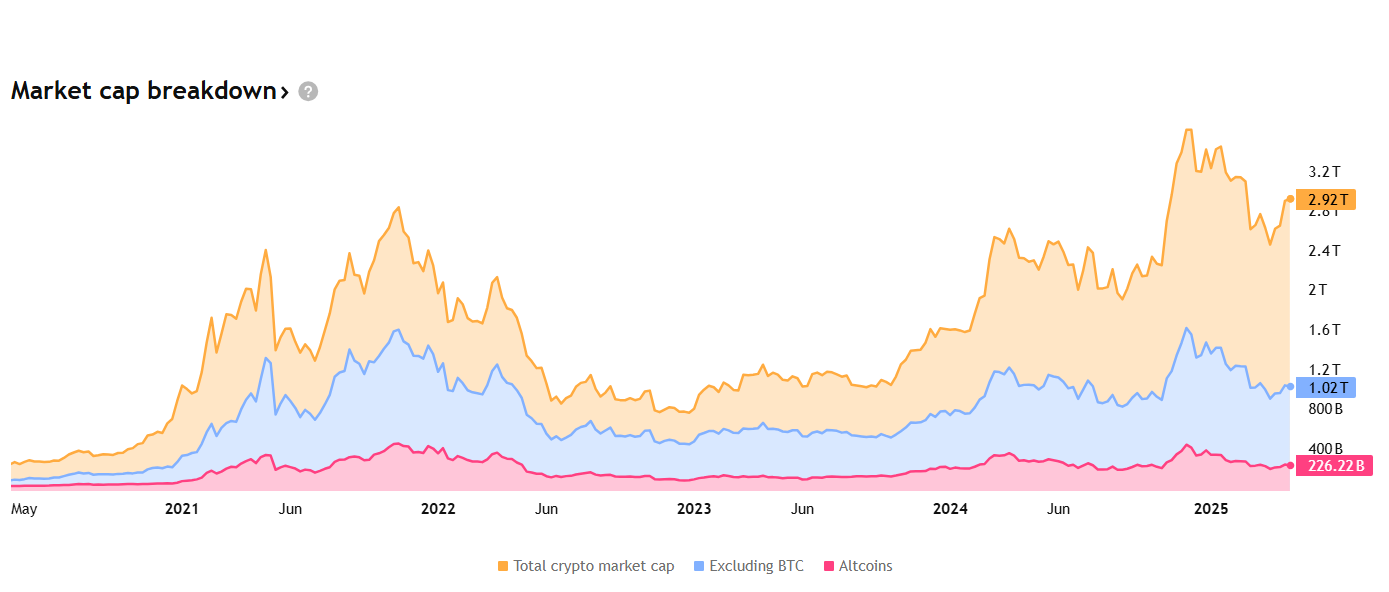

Altcoins: Diverse Results and Upsets

Altcoins experienced all sorts of activity this week some performed well, and some lagged behind. Monero (XMR), a private cryptocurrency, experienced a rapid surge after the news that a 2014 hack on Bitcoin could be linked to North Korea’s Lazarus Group.

As Monero is more private than Bitcoin, individuals began purchasing it as a safe haven. This illustrates that global events, such as hacks and announcements about security threats, can play a huge role in influencing some coins.

At the same time, Aptos began paying $100,000 per month to advertise its platform and entice users. Although this is aggressive marketing, it has not yet manifested in the price of the coin. SUI, a newer Web3 coin, fell by over 6% despite releasing a new feature for games.

On the positive side, Hyperliquid appreciated almost 10% with regular updates and a solid performance that is attracting attention in the derivatives space. This sort of weekly action is typical for altcoins, which is why remaining informed is crucial.

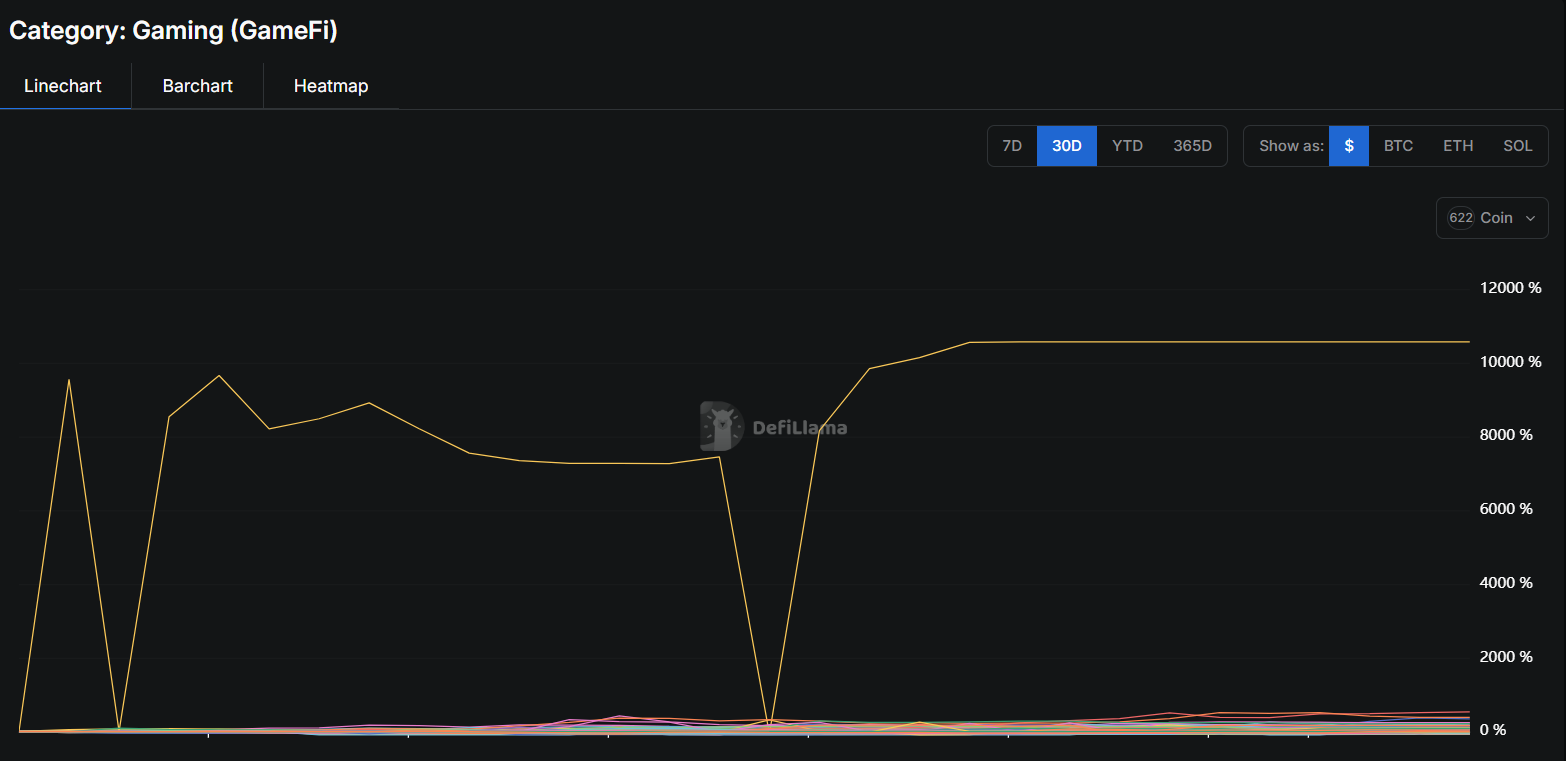

GameFi: Where Gaming Collides With Crypto

The GameFi sector where gaming intersects with finance remained active this week with several thrilling updates. Xborg, the new name in blockchain gaming, launched a $2 million token contest and unveiled more information regarding its governance system.

That will mean that gamers will soon be able to contribute to how the project is operated such as voting on rules for the games or upcoming patches. It’s an indication that Web3 games are not simply for entertainment, but also bestow users with actual influence and possible profits.

Yet another fascinating game, Abstract, added new means by which players can gain rewards and experience points (XP). They even included real-world missions, making the game experience more engaging and significant.

Creepz Playground also released features such as free spins and character fusion, making users stay engaged in the game. All these updates reveal how blockchain games are evolving into ecosystems, wherein play, reward, and community all intertwine deeply.

GameFi: Where Gaming Collides With Crypto

Several new token launches are making headlines in the cryptocurrency community. Two of them, Redacted and Jirasan, both indicated their token launch dates as May 13. Such transparent communication goes a long way in creating hype and building trust among followers.

A successful token launch, if executed properly, can fetch strong initial support and even price spikes, particularly if the project has an established user base to begin with.

Meanwhile, everyone is still eyeing Starknet, which keeps leading social media chatter regarding upcoming tokens. Still, other users are running out of patience and are already starting to feel fed up waiting. This transition is directing attention toward newer and faster-moving initiatives.

In crypto, being the first to have ideas and go first often prevails, and presently, new ideas and first-time launches are attracting most of the attention.

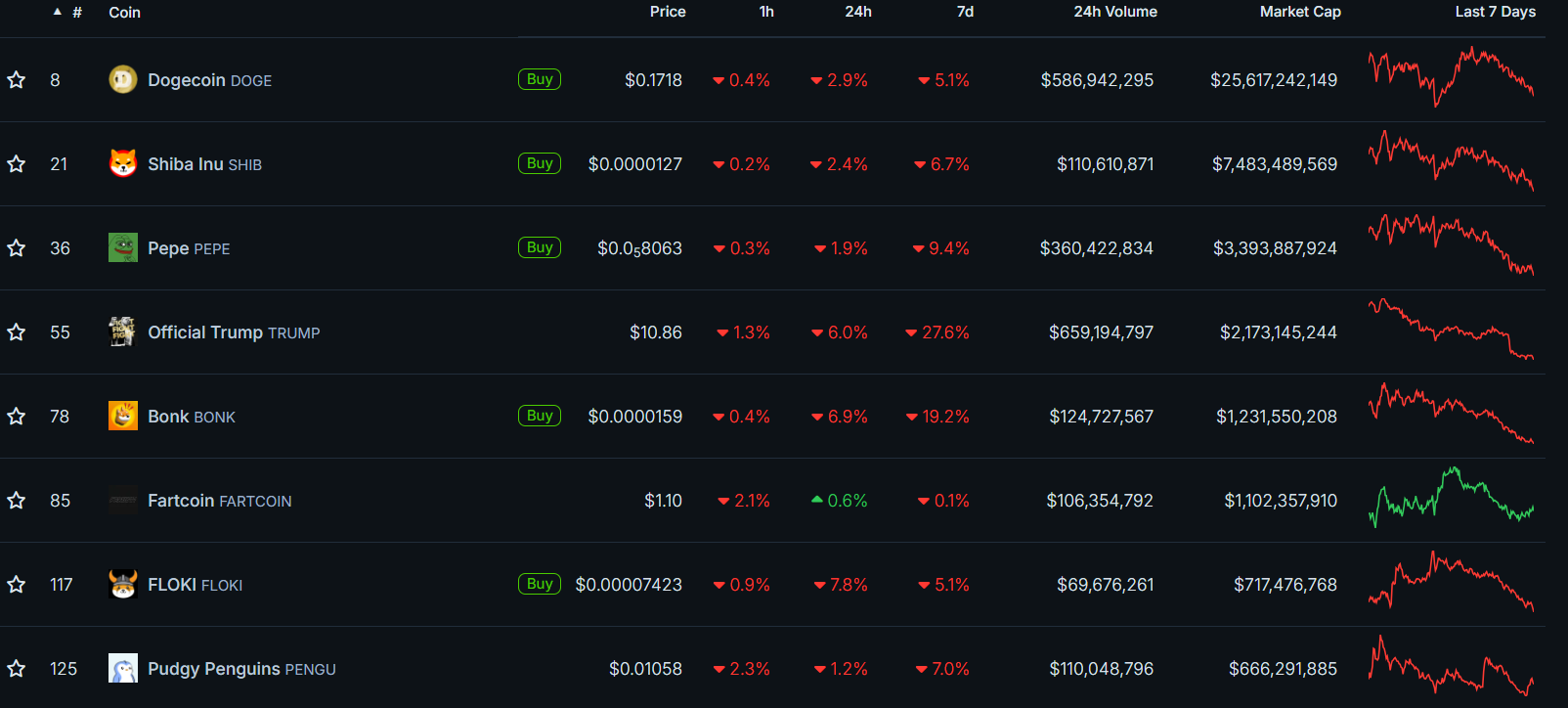

Meme Coins Losing Momentum

Meme coins had a rollercoaster ride last month, but this week, the fervor dissipated. TRUMP, one of the leading meme coins, lost 10% of its value after news broke that Trump Media was going to release its own crypto wallet and token.

Investors were cautious, not knowing how the new developments would impact the value of the existing meme coin. DOGE and other widely used meme coins also failed to do well, indicating the meme coin fad was slowing down.

This cooling off is redirecting focus towards more serious altcoins or newer meme coins with compelling backstories. Although meme coins are entertaining and provide rapid gains, they are also extremely risky and tend to follow hype rather than strong fundamentals. Unless another viral incident occurs, meme coins may continue to lose their luster in the next few weeks.

Ripple’s Big $20B Power Move

Ripple may be gearing up for one of the largest crypto moves, acquiring Circle, the firm behind the widely used stablecoin USDC, for approximately $20 billion. If the deal takes place, it would shake up the game entirely in the world of stablecoins.

Ripple is already involved in fast cross-border payments with crypto, and having USDC under its belt would provide it with tremendous leverage in stablecoin usage in banking and trade.

This has not been officially confirmed yet, but even the rumor has people hyped. If it’s true, Ripple would be among the most dominant companies in crypto. It also indicates how the largest players in the industry are seeking to expand through strategic partnerships and acquisitions, similar to big tech firms.

BlackRock Uses Ethereum for Real-World Assets

BlackRock, the largest asset manager in the world, took a huge leap of faith by using Ethereum to tokenize its \$150 billion Treasury fund. What this means is they’re converting real-world financial assets into tokens on blockchain. This is an unmistakable indication that the traditional finance world (TradFi) is creeping onto the blockchain.

This was facilitated with the assistance of Chainlink and Base, two prominent crypto platforms. It’s a giant leap towards bringing real-world assets (RWAs) onto blockchains, something that experts think can be a trillion-dollar market.

As more institutions get on board, following BlackRock’s lead, Ethereum’s position as the base layer for finance can take off big time.

Mastercard and MetaMask: An Expensive Alliance

MetaMask and Mastercard have introduced a new crypto card, allowing users to spend crypto directly from their wallets. This sounds great, particularly for crypto enthusiasts who wish to spend their tokens on real-world transactions.

But there is a huge catch: the card imposes a 3% fee on transactions, which is extremely high compared to normal credit or debit cards.

Though this card aids in increasing crypto adoption and indicates that large corporations are serious about crypto, the exorbitant fees may prevent many users from using it on a regular basis. It’s progress, but also a reminder that crypto products must be cheaper and more accessible if they hope to be used by the masses.

UK Government Cracks Down on Credit Card Use

The UK banned individuals from using credit cards to purchase crypto. The move came following a report which indicated 14% of individuals in the UK invested in crypto using money they borrowed. The government fears that individuals would lose money that is not their own by trying to make quick money.

This regulation is one of the UK’s wider efforts to put crypto on more solid ground, both in terms of safety and regulation. Sure, it cuts off some possibilities for some people, but it also keeps customers from taking foolish financial risks. It’s a reminder that safe investing is everything, particularly in such a speed-of-light field.

Trump Jumps Into Cry

U.S. President Donald Trump caused a stir by supporting a bill that would allow the U.S. government to purchase 1 million Bitcoin. Meanwhile, Trump Media also unveiled a proposal to introduce a crypto wallet and new token, seeking to engage his loyal supporters using digital assets.

Some are thrilled with this, but others are cautious. Critics charge that this is more about power and politics than real support for crypto. Whatever the motive, though, it’s certain that crypto is stepping into the arena of politics on a grand scale.

Cardano Whales Are on the Move

Large investors, frequently referred to as “whales,” have also been accumulating Cardano (ADA) in abundance lately. Well over 410 million ADA have been deposited into wallets this week, indicating major players think that the coin is likely to rise in price very soon. That type of accumulation tends to herald a price hike to come.

Most ADA enthusiasts feel that it will hit \$0.80 in the near future and potentially target \$1.40 or higher over the next several months. Others are even thinking \$9 during the next major bull run. Those estimates are certainly ambitious, but whale interest returning is certainly a bullish sign for the future of Cardano.

Also Read: Recent Crypto Market Roundup: Major Developments and Trends in April 2025