- Bitcoin sits at 118500 dollars, forming a bullish pennant that could push it to 143280 dollars if the Fed cuts rates.

- A drop below 109380 dollars would signal more sellers, canceling Bitcoin’s bullish outlook.

- Wednesday’s Fed decision, Q2 GDP, and Friday’s jobs report could drive Bitcoin toward 123200 dollars or keep it stuck.

Bitcoin Eyes Breakout Amid Fed Watch

The crypto market is on edge as Bitcoin hovers around 118500 dollars, stuck in a tight range while everyone waits for the Federal Reserve’s interest rate decision on Wednesday.

A technical pattern called a bullish pennant is forming on Bitcoin’s daily chart, which often signals a big price jump after a consolidation phase like this one.

If the Fed cuts rates, analysts say Bitcoin could surge, with a potential target of 143280 dollars based on the pattern’s 20 percent flagpole move. This matches an earlier inverse head-and-shoulders pattern that also points to 143000 dollars, making it a key level to watch.

Bitcoin’s bullish vibe could falter if it drops below 109380 dollars, a sign that sellers are still in control. The Fed’s decision is a big deal because Bitcoin tends to thrive when rates are cut or the Fed signals a softer stance.

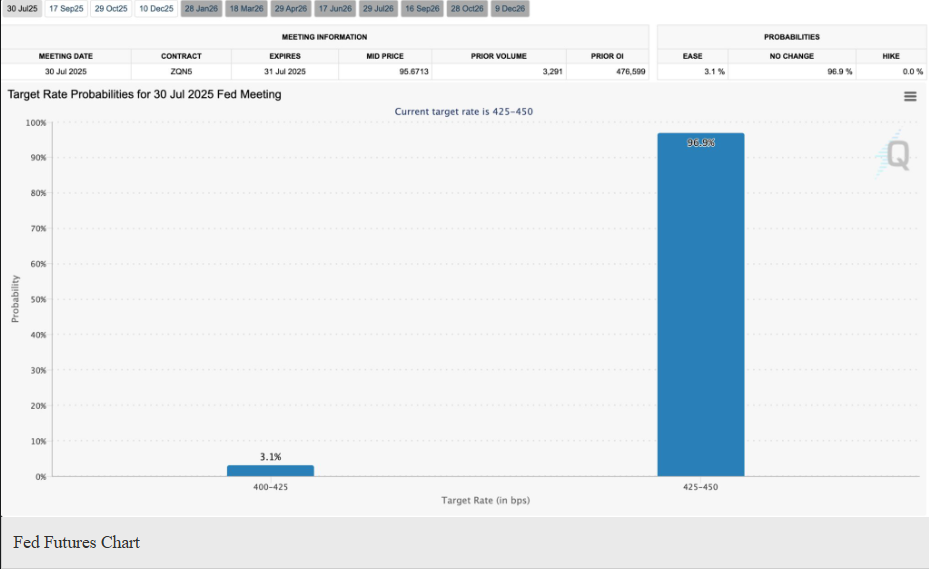

Last year, rate cuts helped Bitcoin hit a record high, and a 0.25 percent cut to a 4 to 4.25 percent range could push it toward its all-time high of 123200 dollars. But the odds of a cut tomorrow are slim, with CME Fed Futures showing just a 3.1 percent chance, though September or October cuts look more likely at 63 and 50 percent.

Other Factors Driving Bitcoin’s Path

Beyond the Fed, Bitcoin’s price could be swayed by other big economic reports this week. The US is set to release its Q2 GDP data on Wednesday and the nonfarm payrolls report on Friday, both of which could shake up the market.

Strong economic numbers might dampen hopes for a rate cut, keeping Bitcoin in its current range, while weaker data could boost expectations for looser policy, lifting Bitcoin.

The crypto’s recent pause comes after a wild rally to its all-time high, and traders are now bracing for a possible short squeeze if buying picks up.

Bitcoin’s technical setup is promising, but it’s not a sure thing. The bullish pennant and inverse head-and-shoulders patterns suggest a breakout could be near, especially if macro events like a Fed rate cut or soft economic data align.

For now, Bitcoin’s sitting at a crossroads, and traders are watching closely to see if it can blast past 123200 dollars toward that 143000 dollar target or if sellers will drag it down. The next few days could be a wild ride for Bitcoin and the crypto market.

Also Read: Crypto news today: A quick look at the major updates and events