- Fed holds rates at 4.25%-4.50% on May 7, 2025, despite push for cuts, due to inflation and unemployment concerns.

- Bitcoin dips to $95,866, then rebounds to $103,000, backed by strong sentiment and $4.41 billion in ETF inflows.

- Delayed 2025 rate cuts could drop it to $70,000, analysts warn, based on Fed’s next moves.

Federal Reserve Leaves Rates Unchanged

On May 7, 2025, the Federal Reserve chose to maintain interest rates between 4.25% and 4.50%. This despite President Donald Trump’s desire for lower rates and blaming Fed Chair Jerome Powell for moving slowly.

According to Powell, the rate was maintained since unemployment is on a slight increase and inflation remains above the Fed’s 2% target.

He further noted that the economy is fine, with low joblessness and robust job market. But he added that individuals and companies are apprehensive, largely due to confusing U.S. trade policies.

This news sent markets into turmoil, particularly cryptocurrencies, as individuals attempted to grasp what it entails.

Bitcoin’s Price Swings and What’s Next

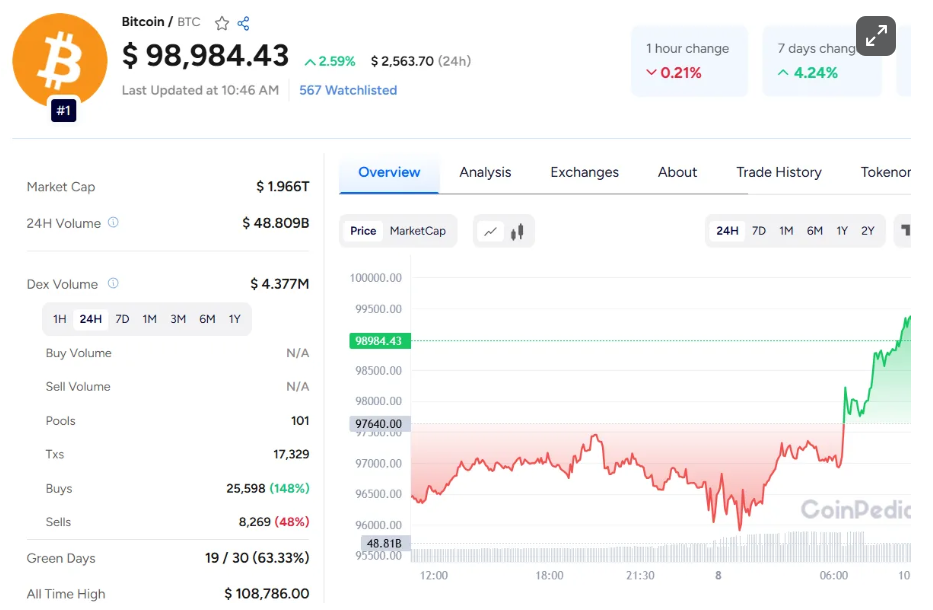

Bitcoin fell immediately following the Fed’s announcement to $95,866. It rebounded quickly, however, and rose above $98,000 toward the end of May 7, a level not reached since February 21.

Bitcoin at $98,984.43 shortly afterwards. Now, it is $103,000, showing that investors are sure about it.

This shows that people are very interested in it, and the Crypto Fear & Greed Index is in “Greed” mode, showing high confidence.

Bitcoin exchange traded funds (ETFs) have also seen $4.41 billion of new money since March 26, which shows that more people are investing. The market is favorable for it currently, but there may be issues down the road.

Analyst Timothy Peterson cautioned that unless the Fed lowers rates in 2025, It will fall to $70,000. Powell further indicated previously that the Fed isn’t rushing to adjust rates, and that provides some ambiguity.

The Fed’s decision to hold rates flat shook Bitcoin, but it recovered immediately. Now that Bitcoin stands at $103,000 and the mood is good in the market, all seems well for the moment.

However, if the rates remain unchanged next year, Bitcoin’s price will have problems. The investors are closely monitoring the Fed and the economy to know where Bitcoin heads next.

Also Read: Raphael Painting Holds Secret: Computer Spots Hidden Clue